ck1racerx

PR Addict

Simple. I know, i dont understand...Not judgin - just sayin?

Simple. I know, i dont understand...Not judgin - just sayin?

I was with Cincinnati Insurance for years. Now I am with Allstate. I have asked the question with both companies. I am covered if stolen at the track or any where else.

As for the go fund me. Really? I hate it when people post those things. You got the money for 3 bikes, a trailer, a motorhome, your racing in Daytona, south Carolina, etc. riding qualifers. Don't be looking for someone else to donate to replace your bikes. My guess is, he had no insurance.

Back in the stone age (80's) I had a bike stolen at a race at Dirt Country.Since OPEN practice...is open, does that mean it's not a "closed course" ?

I really only have insurance for my bikes so that if someone breaks into my home or my vehicle when i'm not at the track I'm covered. I never even think that bikes will be stolen at the track. Now this is going to be the new norm. The days of leaving your stuff unlocked at your rig and walking away are becoming a thing of the past....

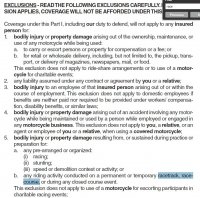

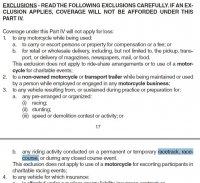

I attached snippets of the exclusions below that are directly from Progressive's motorcycle policy. This exclusion appears in sections 1 thru 4. Section one is Liability/Property Damage and section 4 is the physical damage on the bike itself. The policy also mentions in the exclusion for practice and prepartion for racing. Could this be applied during just a practice day? Possibly. As far as personal auto/motorcycle policies go, there are racing exclusions in all of them. Even in you personal auto policy. It may not be written exactly the way this one is, but they are there. If an agent is telling you otherwise, then ask for it in writing because you will need it when your bike is stolen and the company denies your claim if it happened at a race track.

View attachment 55488 View attachment 55489

It sucks when you pay all this money them and they do everything possible to screw you out of a settlement when you need it.

How is that getting screwed?I pay $800 a year to cover my 3 bikes and my RV, my policies paid me about 52K

How is that getting screwed?

Ah yes ....the insurance debates

Taken right from the Allstate Web site

Beyond Homeowners - Off-Road Vehicle

Your homeowners policy likely does not cover your ATV, golf cart, dune buggy, dirt bike or snowmobile. Check your policy to make sure, but in most cases ATVs and similar vehicles aren't covered under a standard homeowners policy. Most of these insurance policies give you little to no protection for your off-road vehicle, especially once you leave your property.

But that doesn't mean your ATV has to go unprotected. ATV insurance policies can help safeguard your machine.

Although some states don't legally require off-road enthusiasts to insure their vehicles, many owners choose to do so anyway. An ATV policy can protect your vehicle as well as you against liability when operating a fast and responsive off-road vehicle.

The Essentials

So when you're in the market for off-road insurance, check that your carrier offers the following forms of protection:

- Collision Coverage. You wind up hitting someone's fence, a fallen tree or possibly another off-road vehicle. The costs of repairing damages to your off-road vehicle can run into thousands of dollars. Collision coverage helps cover the repairs to your vehicle. It gets your dirt bike back on the trail!

- Bodily Injury Liability. If you have an accident and someone else is hurt, you could be liable for that person's medical expenses which could include doctor, hospital and dentist bills. Bodily injury coverage provides coverage for that person's medical expenses. You wouldn't drive a car without this coverage, so why would you drive a golf cart without it?

- Property Damage Liability. In the event you cause damage to someone else's property, such as a home, cabin or vehicle, this insurance will cover the costs of repairs to the structure. Don't get stuck paying potentially expensive property damage for which you're liable. Property damage liability coverage can help protect you financially from these costly accidents.

- Comprehensive Coverage. What happens if a tree limb falls on your ATV while you're camping? And what if it's stolen? Or if it's damaged in a severe wind storm? With comprehensive coverage, your off-road vehicle is protected in events ranging from natural disasters to theft.

I'm waiting for you to post the coverage for recreational vehicle specific policies......I know I wasn't talking about having insurance for your dirt bike through your home owners policy.